In my blog entitled “9 Steps to Achieve Financial Freedom”, I mentioned a short description of emergency savings. This blog will primarily focus on emergency funds or saving for rainy days. Life can be full of uncertainties. You will never know what will happen in the future. We can only hope that something good will come. What if the future doesn’t turn out the way we hoped for? What if something unfortunate happens? Are you prepared for it?

Hope for the best. Expect for the worst!

There’s a saying “Hope for the best. Expect for the worst!”. This is a good mindset in preparing for your future. No matter how good your present life is doing now, you still don’t hold the certainty of the future. One should always be prepared.

Here are some of the realistic and unfortunate life scenarios that can happen

- Critical Illness – You or your family member suddenly hospitalized due to deadly diseases like renal failure, acute heart disease, or cancer, etc.

- Death of Main Income Provider – Usually the father but it could be anyone in the family who has major financial responsibility

- Disasters – House fire, Natural calamities & human-initiated calamities like war & pandemic like COVID19

- Unemployment or Bankruptcy – Uncertainties in the economy may cause you to lose your source of income. This can be due to economic recession, war, disasters, or pandemics like what is happening now with COVID19. Many had been unemployed especially in the Manufacturing, Tourism, Construction, Industries, and Mining sectors

- Robbery – Moveable items can get stolen like cars, watch, gadgets, or even your bank account because of scams.

- Accidents – This happens every day and it could happen to anyone no matter how careful you are. Even if you are just chilling and drinking peacefully at a restaurant, an accident may happen. I suggest you do watch the movie Final Destination.

These are all realistic events that are beyond our control which may or may not happen. We should all prepare for these uncertainties by setting aside a portion of our money for these kinds of events. If none of these events happens in the future, then you end up with a substantial amount of extra funds that you can use for your retirement. It’s a win-win situation.

The fact is, many of us even struggle to save up some money for the rainy days because income is just enough for basic necessities. I know, I have experienced this. Let me tell you one thing, it is not about the amount of money that you save, it’s all about conditioning and training yourself to save money regardless of the amount. So, what you should do with your limited funds and how are you going to save money for future uncertainties or emergencies?

It’s not about what you have, It’s what you do with what you have!

Here are some simple tips that will help us put an end to your suffering emergency funds situation

- Create a Budget Formula

- Open a Separate Bank Account

- Coin Bank for Adults

- Find Other Sources of Income

- Buy an Insurance

1. Create a Budget Formula – That will Always Include the Savings Component

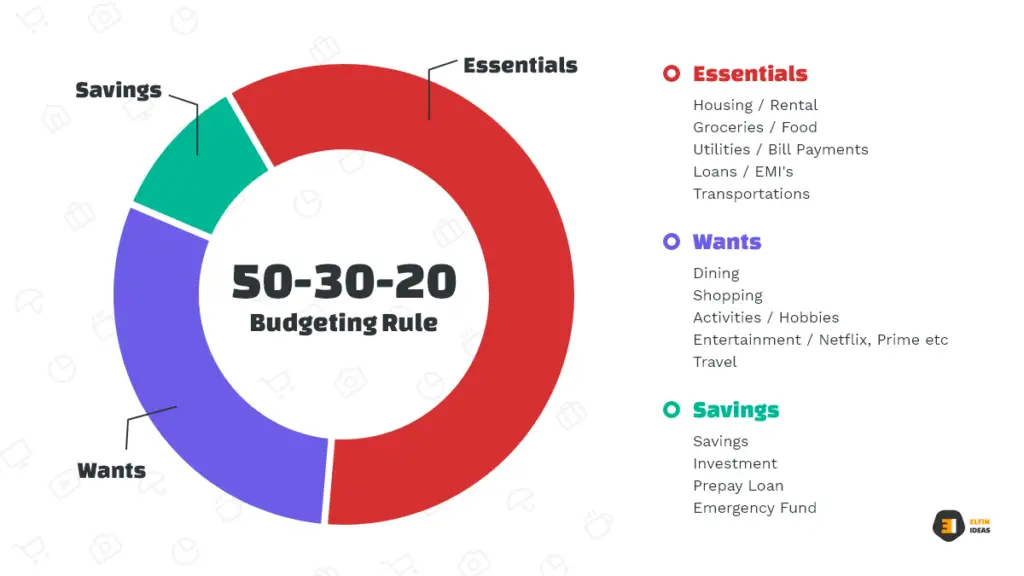

There is no perfect formula because every person’s situation is unique but ideally, you should save 20% of your income. What is important is that you save to the best you can. Train yourself and once you get used to saving, it will become part of your lifestyle. Once it becomes part of your lifestyle, you will feel encouraged to save even more than 20% of your income if higher.

A successful emergency fund should be equal to or more than 6 month’s worth of your current salary. This is your goal that you must focus on.

2. Open a Separate Bank Account

Saving is hard, right? Especially if you keep seeing your ATM and credit cards. Seeing funds in your payroll account makes you feel like you still have more money to spend. It can be a temptation. Whenever you have extra money, regardless of amount, deposit it to a separate savings account at a different bank from your payroll.

Consider this account as an “emergency funds basket”. Don’t claim your ATM. This will somewhat make it harder to withdraw because you should just be depositing and no withdrawals unless it’s an emergency. Starting to discipline and train yourself is hard. It’s called “Tough Love”. Your goal is to save at least 6 month’s worth of salary but if you can do more, then never hesitate to do it.

One more thing, a credit card is not an emergency saving fund. It’s a loan although you can use it for emergencies. Only use your credit card if,

- You know you have money to pay it once it falls due

- Extreme emergencies wherein you have exhausted even your emergency savings funds

Some of Banks with zero or low maintaining balance accounts

3. Coin Bank for Adults

Piggy banks and coin banks are not just for kids. It’s also for the kids at heart (or maybe kids in mind too). Nobody needs to be a financially savvy person or take financial courses just to learn how to save money in a piggy bank. Even people with a minimum salary can do this.

Let me make you realize one thing, ₹50 or ₹20 in a day is a small amount that probably most of us may not even feel or notice if it gets lost. If you put that small bill in your coin bank every day, that will sum up to ₹18,250 (50×365).

Is it a small amount? No, because your neighbors and colleagues choose to spend their 50 rupees on ice cream and snacks so they have zero rupees. That is small. If you can afford to buy street foods or snacks for ₹50 a day, then this Coin Bank challenge is a breeze for you.

The Focus of your goal – Savings worth six months of your salary. It doesn’t matter how long it will take you to finish it as long as you are taking those tiny first steps.

4. Find Other Sources of Income

The truth is, many of us belong to marginalized income communities. Salaries barely meet the needs of a single person, what more if you have a family? If you are extremely unfortunate that even ₹50 would hurt your budget (really?), then find other sources of income other than your salary. It can be a new job or a part-time job or even freelancing. Who knows, maybe your freelancing will earn more than your day-job.

Some of Freelance and Part time job portals

5. Buy an Insurance – With the Lowest Monthly Amortization

Many people don’t prioritize getting insurance because it doesn’t seem to be an urgent need. Let’s be real! The only certain events that will happen in a lifetime is sickness and death.

Sickness could be mild or acute. Most people who die, get sick first. That’s double jeopardy, the cost of hospitalization and funeral. If you can save up for a wedding which you don’t know if it will happen (because you are still single), why not save for what is certainly going to happen?

This may not be a savings plan but it is an emergency plan. Savings can make you feel that it is optional and you can skip it anytime while paying for insurance is an obligation. Come to realize it, when a person is given an obligation, you become more responsible.

If a person is given an option, they choose the easier option. The good thing about insurance is that even if you have not finished paying for it, the company will pay you in full if such covered uncertainties happen to you. Not all insurance is expensive. Look for stable companies and ask for the lowest insurance quote. If you are still in your 20’s, chances are, the cost of your insurance is just the same as your coin bank challenge or ₹50 a day.

It is best if you can find a traditional insurance coverage only for life, sickness, and accident but many insurances nowadays have an investment component as well. Don’t focus on the investment component, focus on the protection. Discuss more the details of life insurance, the investment component is just a bonus add-on. If you want to invest or learn to invest, you might as well get a separate fund just for investment.

If you are a little bit well off and you have properties, there is also non-life insurance that can cover for your loss or damage to your properties such as fire insurance and car insurance.

Check out the Top 24 Life Insurance Companies in India

Let me know in the comments below if you have any other ideas on how to push people to save for the rainy days.